On Air Now

Mark Foster

Coronavirus: Help for employees

There's lots of talk about workers being "on furlough".

There's lots of talk about workers being "on furlough".

Your employer could pay 80% of your wages through the Coronavirus Job Retention Scheme, up to a monthly cap of £2,500.

You’ll still be paid by your employer and pay taxes from your income.

The key thing is that you cannot undertake work for your employer while on furlough. The scheme is expected to start at the end of April.

Key Points

*Both you and your employer must agree to put you on furlough. You cannot apply for the scheme yourself.

*Any UK employer with a UK bank account will be able to claim, but you must have been on your employer’s PAYE payroll on 28 February 2020.

*You can be on any type of contract, including a zero-hour contract or a temporary contract.

*The grant will start on the day you were placed on furlough and this can be backdated to 1 March.

Your employer will get a grant to cover 80% of your monthly earnings, up to a maximum of £2,500. Firms will be eligible for the grant once you have been furloughed, from 1 March.

Your employer:

- will pay you at least 80% of your usual monthly earnings, up to a maximum of £2,500, as your wage

- can claim for a minimum of 3 weeks and for up to 3 months - but this may be extended

- can choose to pay you more than the grant - but they do not have to

You’ll still pay Income Tax, National Insurance contributions and any other deductions from your wage.

While you’re on furlough

Your employer will need to notify you before putting you on furlough.

Once you are on furlough you will not be able to work for your employer, but you can undertake training or volunteer subject to public health guidance, as long as you’re not:

- making money for your employer

- providing services to your employer

If workers are required to for example, complete training courses whilst they are furloughed, then they must be paid at least the NLW/NMW for the time spent training, even if this is more than the 80% of their wage that will be subsidised.

Any activities undertaken while on furlough must be in line with the latest Public Health guidance during the COVID-19 outbreak.

Your employer can still make you redundant while you’re on furlough or afterwards.

Your rights as an employee are not affected by being on furlough, including redundancy rights.

If your employer chooses to place you on furlough, you will need to remain on furlough for a minimum of 3 weeks. However, your employer can place you on furlough more than once, and one period can follow straight after an existing furlough period, while the scheme is open. The scheme will be open for at least 3 months.

If you were made redundant after 28 February

Your employer can agree to re-employ you and place you on furlough instead. They’ll still be able to claim a grant to cover 80% of your monthly earnings, up to a monthly cap of £2,500.

If you currently have more than one employer

You can be put on furlough by one employer and continue to work for another, if it is permitted within your employment contract.

If you’re put on furlough by more than one employer, you’ll receive separate payments from each employer. The 80% of your normal wage up to a £2,500 monthly cap applies to each job.

If you are on Universal Credit

If you’re earning less because you’re on furlough, your Universal Credit payment might change - find out how earnings affect your payments.

If you are on Maternity Leave, contractual adoption pay, paternity pay or shared parental pay

You must take at least 2 weeks Maternity Leave (4 weeks if you work in a factory or workshop) immediately following the birth of your baby. This is a health and safety requirement. In practice, most women start their Maternity Leave before they give birth and you may want to do this.

If you are eligible for Statutory Maternity Pay (SMP) or Maternity Allowance, the normal rules apply, and you will be entitled to claim up to 39 weeks of statutory pay or allowance.

If you qualify for SMP, you will still be eligible for 90% of your average weekly earnings in the first 6 weeks, followed by 33 weeks of pay paid at 90% of your average weekly earnings or the statutory flat rate (whichever is lower). The statutory flat rate is currently £148.68 a week, rising to £151.20 a week from April 2020.

Some employers ‘top up’ Statutory Maternity Pay and their employees are eligible for an enhanced, earnings related rate of pay. If you are eligible for enhanced (contractual) maternity pay from your employer this is included within the wage costs that your employer can claim through the scheme. The same principles apply if you qualify for contractual adoption pay, paternity pay or shared parental pay.

If you are currently pregnant and due to start Maternity Leave

You will start Maternity Leave as usual. If your earnings have reduced due to a period on furlough or statutory sick pay prior to your Maternity Leave starting this may affect your Statutory Maternity Pay. The same principle applies to contractual adoption pay, paternity pay and shared parental pay

If you do not want to go on furlough

If your employer asks you to go on furlough and you refuse you may be at risk of redundancy or termination of employment, depending on the circumstances of your employer. However, this must be in line with normal redundancy rules and protections.

Recently Played

-

Don't Look Any Further

M People -

Haven't Met You Yet

Michael Buble -

Best Day Of Our Lives

Dear Alice -

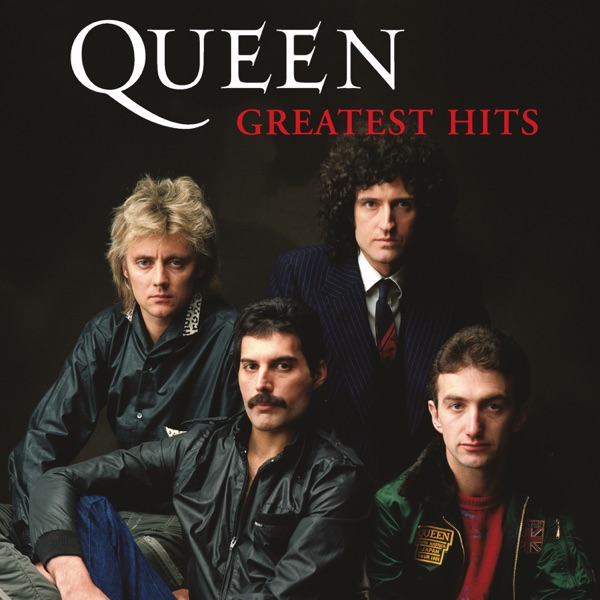

Don't Stop Me Now

Queen